As traditional banks embrace crypto investments, they are reimagining their approach to financial services. Understanding these shifts is crucial, as they may define the future of banking, merging legacy systems with innovative digital assets to enhance customer experiences.

Understanding the role of crypto investments in banking

In recent years, legacy banks have increasingly recognized crypto investments as a pivotal area for growth and innovation. Institutions like JPMorgan and Goldman Sachs are now venturing into cryptocurrency offerings, previously hesitant due to regulatory uncertainties. This change highlights how financial institutions are adapting to the evolving crypto landscape to remain competitive and relevant. According to a report, as various banks begin to embrace digital currencies, they are transforming their operational frameworks to integrate these asset classes, thus reshaping traditional banking models (TheStreet).

These investments in cryptocurrencies are not merely a trend. Rather, they represent a strategic pivot towards innovative financial models that can meet the demands of tech-savvy consumers. By diversifying their portfolios to include digital assets, banks are positioning themselves to capture a growing market segment that prefers modern financial solutions.

Financial transformation in the age of digital assets

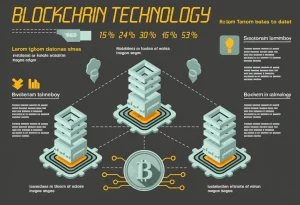

The advent of digital assets has prompted considerable changes in banking operations. Banks are now leveraging blockchain technology to improve efficiency and transparency in transactions. This financial transformation is driven by the need to provide faster, more secure, and more cost-effective services. As Bessent warns, adaptation is crucial for survival in a competitive market (TheStreet Crypto).

The benefits of adopting digital assets are manifold:

– Enhanced Security: Cryptographic technology provides superior protection against fraud and cyber threats.

– Increased Efficiency: Blockchain facilitates quicker transactions, reducing the need for intermediaries.

– Cost Reduction: By streamlining processes, banks can lower operational costs significantly.

However, banks face substantial challenges in integrating digital assets, including regulatory compliance and the need for technological investments. Addressing these obstacles is vital for any legacy institution aiming to succeed in a transformed financial landscape.

Current trends shaping crypto in banking

Recent case studies illustrate the growing trend of banks implementing cryptocurrency. For instance, some institutions are now offering services such as crypto custody and trading to meet rising consumer demands for these digital assets. With a clear surge in interest, more individuals are seeking opportunities in cryptocurrencies, driving banks to adapt accordingly.

Regulatory changes play a crucial role in this evolution. In many regions, regulatory bodies are drafting frameworks to support financial transformation while protecting consumers and maintaining market stability. As banks navigate these regulations, they are also forging partnerships with fintech companies and crypto startups to bolster their technological capabilities and enhance their offerings.

Why legacy banks are exploring crypto technology

The motivations behind banks investing in crypto technology are multifaceted. Competitive pressures from fintech and rising crypto startups have pushed traditional financial institutions to innovate. As younger consumers increasingly prefer digital-first solutions, banks realize that neglecting this trend could cost them market share.

Partnerships between banks and crypto firms have emerged as a solution to accelerate this transition. By collaborating with agile startups, traditional banks leverage their expertise in compliance and risk management while the startups provide innovative technological solutions. This symbiotic relationship is paving the way for a more integrated financial ecosystem that combines the reliability of banks with the flexibility of crypto solutions.

Considering the risks associated with crypto adoption

While the integration of crypto offers numerous advantages, banks must be wary of potential risks. Market volatility is a significant concern; sudden fluctuations can jeopardize profitability and consumer confidence. As traditional banks delve into digital assets, they must also contend with increased cybersecurity challenges. The decentralized nature of cryptocurrencies, while beneficial, exposes institutions to new risks regarding data breaches and hacking attempts.

Moreover, the lack of established legal frameworks around digital currencies can lead to compliance hurdles. Banks need to adopt comprehensive risk management strategies to navigate these complexities effectively. Balancing innovation with security is essential for safeguarding their operations and customer interests in this evolving landscape.

Actionable steps for banks transitioning to crypto solutions

For legacy banks looking to venture into the world of crypto, several actionable strategies can facilitate this transition:

1. Develop a Clear Strategy: Establish a comprehensive plan for integrating cryptocurrencies into existing services.

2. Invest in Technology: Leverage blockchain technology to streamline operations and enhance security.

3. Prioritize Employee Training: Equip staff with the necessary skills to understand and manage crypto finance.

4. Adopt Best Practices: Learn from successful crypto leaders and incorporate their strategies into banking operations.

By following these steps, banks can position themselves advantageously in a rapidly changing financial landscape. Embracing innovation while maintaining robust risk management practices will be key to thriving in the new banking paradigm.

More Stories

Why Political Engagement with Cryptocurrency Is About to Change Everything in Finance

How Governments Are Using Blockchain to Transform Green Initiatives

The Hidden Truth About Trump’s Policy Impact on Bitcoin’s Volatility