Smart contracts are dumb. They do exactly what they’re programmed to do, nothing more. Sounds like a feature but it’s actually a massive limitation.

Your yield farming contract sits in a pool earning 3% APY. Right next to it, another pool offers 15% APY with similar risk profile. Your contract doesn’t notice. Doesn’t care. Just keeps farming that 3% because that’s what the code says. You’re losing money every day through sheer algorithmic stupidity.

DeFi users spend hours monitoring positions, manually rebalancing portfolios, hunting for better yields, adjusting strategies. It’s exhausting. Professional traders use bots but bots run off-chain – you’re trusting someone else’s server, someone else’s code, someone else’s intentions. The bot operator could front-run you, change logic without notice, or just disappear.

DAOs make decisions through governance votes but nobody has time to analyze every proposal properly. Most voters just follow whatever large holders recommend. Data-driven analysis? Rare. Most governance is vibes and tribal loyalty.

Nexiphron emerged from simple question: what if smart contracts could actually think? Not just execute code, but observe results, learn from patterns, optimize themselves automatically? What if you could deploy a yield farming strategy that continuously hunts for best returns without your intervention? Set parameters, walk away, let AI handle the details.

Two AI researchers from OpenAI and DeepMind plus a Solidity developer from Aave met at ETHGlobal hackathon in February 2025. By drinks three they were sketching on-chain machine learning architectures. By March they’d incorporated. By November they launched mainnet with first AI-powered autonomous yield optimizers.

Nexiphron Token (NEXH) launched November 2025 at $0.12. Currently trading $0.15-0.18 with roughly $195-234 million market cap. Small, early, experimental. The token fuels AI computations on-chain – every inference costs NEXH. Stake tokens to help train models, earn rewards. The more DeFi capital managed by Nexiphron’s AI agents, the more NEXH demand.

Is this revolutionary or just over-engineered complexity? Can machine learning actually work on-chain given gas costs and determinism requirements? Does DeFi need this or are simple strategies sufficient?

Let’s find out.

The Problem With “Dumb” Smart Contracts

Ethereum smart contracts are deterministic state machines. Give them input A, they produce output B. Every time. Predictably. This is security feature – you know exactly what contract will do. No surprises.

But determinism means inflexibility. Market conditions change constantly. Optimal strategies shift. Interest rates fluctuate. Liquidity migrates between protocols. Your smart contract doesn’t adapt – it executes the same logic regardless of circumstances.

Real example from DeFi summer 2024: Curve pool offering 12% APY on USDC/DAI suddenly dropped to 4% as liquidity fled to new Aave market offering 18%. Yield farmers with automated Yearn vaults had to wait for Yearn strategists to manually update allocation. Days passed. Thousands of dollars in opportunity cost per user.

Why didn’t the contract just move capital automatically? Because Yearn vaults are pre-programmed strategies. Strategists write code, deploy it, capital follows that code until strategists write new code. There’s intelligence in the system but it’s off-chain human intelligence, not on-chain contract intelligence.

DEX market makers on Uniswap v3 face similar problem. Concentrated liquidity is powerful but requires constant active management. You set a price range for your liquidity. Price moves outside range? You earn zero fees. Price volatility increases? Your fixed range bleeds impermanent loss. Optimal strategy is adjusting ranges constantly based on volatility, volume, and price trends.

Some LPs use bots for this. Visor Finance, Gamma Strategies, others provide automated range management. But these are centralized services. You’re trusting their bots, their servers, their intentions. The bot logic is proprietary – you can’t verify what it’s doing. If service shuts down or gets hacked, you’re stuck.

Arbitrage opportunities exist cross-chain constantly. Token cheaper on Arbitrum than Optimism? Buy there, sell here, pocket difference. But by the time humans notice and act, bots already captured the alpha. And traditional bots are off-chain programs monitoring blockchains, calculating opportunities, submitting transactions. Centralized, trust-based, often front-running regular users.

DAOs struggle with data-driven decision making. Proposals get submitted – “Should we allocate 20% of treasury to this protocol?” – and voting happens based on vibes. Who has time to analyze risk/reward properly? Professional governance participants exist but they’re rare. Most voters are part-time, busy people clicking approve on whatever sounds reasonable.

Existing solutions are inadequate. Chainlink Automation provides on-chain automation but it’s simple conditional logic – “if X happens, do Y.” No learning, no optimization, no intelligence. Just automated execution of pre-defined rules.

Off-chain AI and ML tools exist for crypto trading. TradingView indicators, prediction bots, sentiment analysis. But they’re all external to the blockchain. You’re trusting black boxes, paying subscriptions, hoping the bot doesn’t rug you.

What DeFi needs: on-chain intelligence. Smart contracts that observe, learn, optimize. AI agents living inside the blockchain, making decisions based on data, improving over time. Transparent, auditable, trustless.

That’s what Nexiphron attempts to build.

The Origin Story

Dr. Alex Chen spent five years at OpenAI working on reinforcement learning. His team trained models that learned to play complex games through trial and error, no human instruction. The models started terrible, made thousands of mistakes, gradually discovered optimal strategies. Same approach could work for DeFi – let algorithms learn what works through experimentation.

Dr. Sophia Laurent worked at DeepMind on financial prediction models. She specialized in decision-making under uncertainty – exactly what yield farming requires. You don’t know future returns, you can only estimate based on historical data and current conditions. Her models could do this well.

Marcus Rivers was protocol engineer at Aave for three years. He understood smart contract architecture intimately, knew EVM limitations, wrote Solidity code for managing billions in DeFi capital. He also knew Aave’s interest rate algorithms were manually designed, not optimized by ML. They worked but weren’t optimal.

ETHGlobal hackathon in San Francisco, February 2025. Alex and Sophia attended because they were interested in crypto but hadn’t built anything yet. Marcus was there recruiting engineers. They ended up at the same after-party.

Conversation started with Marcus complaining about manual strategy management. Aave adjusted interest rate curves maybe once per month. Slow, reactive, not optimal. Alex mentioned reinforcement learning could optimize this automatically – train a model to set rates that maximize protocol revenue and usage.

Sophia pointed out the gas cost problem. Running ML inference on-chain would cost millions in gas. Nobody would use it. Also determinism issue – ML models need randomness for exploration, but blockchains are deterministic. Seems impossible.

But maybe not entirely impossible. What if you used extremely lightweight models? Decision trees with 100-1000 parameters, not neural networks with millions. Inference would still cost 50k-150k gas but that’s manageable for high-value operations. A yield optimizer managing $1M in capital could afford $20-50 in gas every few hours to optimize allocation.

Determinism could be handled with on-chain randomness (VRF) or by making models purely deterministic – no exploration, only exploitation of learned patterns.

They sketched architecture until 3 AM. On-chain AI agents that store model weights as contract state. Inference functions that load weights, run calculations, output decisions. Training could happen off-chain (cheaper) then weights upload to chain (expensive one-time cost). Or training could happen on-chain gradually through reinforcement learning – models earn rewards for profitable decisions, update weights accordingly.

They incorporated Nexiphron Labs in March 2025. Raised $12M seed round by May from Paradigm (lead), a16z crypto, Pantera Capital, Coinbase Ventures. The pitch: make smart contracts actually smart using AI.

The technical challenges were substantial. EVM wasn’t designed for ML workloads. Matrix multiplication is expensive. Floating point math doesn’t exist on-chain (everything’s integers). They had to build custom precompiles, optimize algorithms ruthlessly, compress models aggressively.

Testnet launched July 2025 with first proof-of-concept: autonomous yield optimizer for stablecoin farming. It worked. The AI agent moved capital between Aave, Compound, and Curve automatically, consistently beating static strategies by 2-4% APY. Gas costs were $30-50 daily for managing $500k, easily covered by improved returns.

Mainnet launched September 2025. Initially just the yield optimizer on Ethereum mainnet. Managed $15M in first week. Grew to $80M by November.

Token generation event November 2025. NEXH listed on Gate.io and Uniswap. Started at $0.12, pumped to $0.28 on AI hype, corrected back to current $0.15-0.18 range.

Mission statement: “Make smart contracts actually smart.” Less catchy than it could be but accurate. They’re bringing machine learning to blockchain in practical, gas-efficient way that actually works.

How Nexiphron Technology Actually Works

Four core innovations make on-chain AI feasible. Each solves specific technical problem that previously made this impossible or impractical.

On-Chain AI Agents are lightweight ML models stored as smart contract state. Not complex deep neural networks – those would cost millions in gas to run. Instead: decision trees, linear models, small neural nets with 100-1000 parameters.

Model architecture is carefully designed for gas efficiency. No convolutions, no attention mechanisms, no recurrent connections. Simple feedforward networks or decision trees that can execute in 50k-150k gas per inference.

The models take input (current yields across protocols, gas prices, slippage estimates, risk scores) and output decisions (allocate X% to Aave, Y% to Curve, Z% to Compound). Simple enough to run on-chain, sophisticated enough to beat static strategies.

Model weights are stored as contract state variables. A 500-parameter model requires ~15KB storage. Expensive to store (150k+ gas) but it’s one-time cost during deployment. After that, inference just reads the weights and computes, no storage writes needed.

Training happens off-chain mostly. Nexiphron runs GPU clusters training models on historical DeFi data. Once model performs well, weights get uploaded to blockchain. This hybrid approach keeps costs manageable while enabling sophisticated learning.

Self-Optimizing Logic allows contracts to improve themselves over time. Instead of fixed weights, some Nexiphron agents use on-chain reinforcement learning. They start with initial weights, make decisions, observe results, update weights based on performance.

The update mechanism uses gradient descent implemented in Solidity. After each action (moving capital, rebalancing portfolio), contract calculates reward (profit earned minus gas costs). If reward is positive, weights that produced that decision get strengthened. If negative, they get weakened.

This happens slowly – maybe once per day or week. Gas costs for weight updates are 100k-200k per update. Expensive but worth it if managing significant capital. A yield optimizer managing $10M can afford $50 in daily optimization costs if it improves returns by even 0.1%.

The learning is conservative and bounded. Models can’t change weights by more than 5% per update. Prevents catastrophic forgetting or wild strategy swings. Emergency circuit breakers halt learning if performance degrades significantly.

Example: yield optimizer starts by allocating equally across three protocols. Over time it learns Aave usually offers better risk-adjusted returns than Compound for USDC. Weights gradually shift toward Aave. But if Aave gets exploited or rates drop, the model adapts within days.

Cross-Chain Intelligence lets AI agents analyze data from 20+ blockchains simultaneously. Uses Chainlink CCIP for cross-chain messaging and Chainlink oracles for off-chain data.

An AI agent on Ethereum can read current USDC yields on Arbitrum, Optimism, Polygon, Base, all L2s. It identifies where yields are highest, calculates gas and bridge costs for moving capital, makes optimal decision.

This enables sophisticated strategies impossible for humans to track manually. Liquidity constantly migrates between chains chasing incentives. AI agents follow automatically, moving capital to wherever returns are best after accounting for costs.

Portfolio rebalancing across chains becomes automatic. You deposit assets on Ethereum, AI manages positions across 10 chains simultaneously, rebalancing as opportunities emerge. You see one aggregated position, AI handles complexity behind scenes.

The cross-chain data comes from Chainlink price feeds and custom oracles Nexiphron operates. Oracle data includes: current APYs, liquidity depths, gas prices, bridge fees, slippage estimates. AI agents consume this data, run inference, output multi-chain strategies.

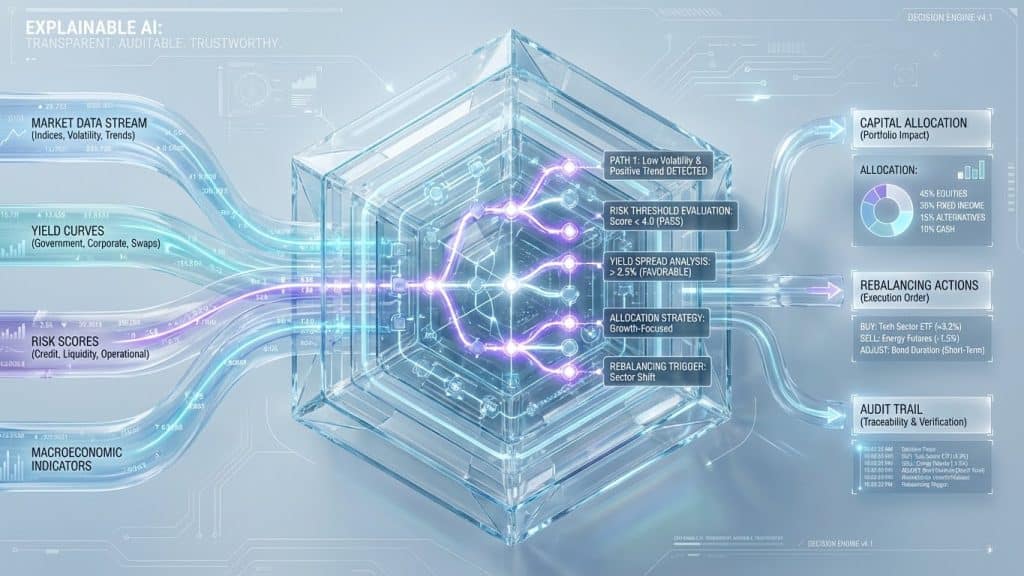

Risk-Adjusted Auto-Execution prevents AI from taking excessive risks. Models evaluate risk before every decision using multiple factors:

Smart contract audit scores from firms like Trail of Bits and OpenZeppelin. Recently deployed protocols get lower risk scores. Battle-tested protocols (Aave, Compound, Uniswap) get highest scores.

Liquidity depth matters. A pool with $500k liquidity is riskier than one with $50M – smaller pools face manipulation risks and higher slippage.

Historical volatility indicates risk. Protocols with stable TVL and returns are safer than ones with wild fluctuations.

The AI combines these into composite risk score for each protocol/strategy. Users set risk tolerance when deploying their AI agent: conservative, moderate, or aggressive. The agent only executes strategies matching user’s tolerance.

Emergency circuit breakers activate if AI detects anomalies: sudden liquidity drops, exploit attempts, extreme volatility, or smart contract upgrades (new code could have bugs). Agent pauses operations until human reviews situation or conditions normalize.

Explainable AI Component provides transparency. Every decision an AI agent makes gets recorded on-chain with reasoning. Not just “moved 50 ETH to Aave” but “moved 50 ETH to Aave because: current rate 4.2% vs Compound 3.8%, liquidity depth sufficient ($200M), risk score 9/10, expected profit $85 daily minus $12 gas.”

Users can review decision history, understand why AI chose specific actions. Auditors can verify AI followed its rules and risk parameters. DAOs governing Nexiphron protocols can analyze aggregate AI behavior.

This transparency builds trust. Black box AI making financial decisions is scary. Explainable AI showing its work is much more acceptable for managing real money.

The technical architecture is innovative but pragmatic. They’re not trying to run GPT-4 on blockchain. They’re building narrowly specialized AI agents optimized for specific DeFi tasks, gas-efficient enough to be practical, transparent enough to be trustworthy.

Use Cases That Need Self-Optimizing Contracts

Autonomous Yield Optimizers are the obvious first application. Yearn Finance pioneered yield aggregation but strategies are manually designed and infrequently updated. Nexiphron’s AI version continuously hunts for best yields across all protocols and chains.

User deposits USDC to Nexiphron yield vault. AI immediately analyzes current rates: Aave 4.2%, Compound 3.8%, Curve 5.1%, Convex 4.9%, plus opportunities across 8 different L2s and sidechains. It allocates capital optimally after considering gas costs, bridge fees, slippage.

Market conditions change hourly. Curve incentives get boosted, yield jumps to 8%. AI notices within minutes, rebalances to capture higher returns. No human intervention needed.

Over weeks and months, the AI learns patterns. Thursday mornings often see yield spikes on certain protocols (whales rebalancing portfolios?). Friday afternoons see rate drops (people withdrawing for weekend spending?). The model incorporates these patterns into decisions.

Current Nexiphron yield vaults outperform Yearn by 1.5-3% APY on average after gas costs. Might not sound huge but on $100k investment that’s $1,500-3,000 extra annual return. Compounds significantly over time.

Self-Rebalancing Portfolios maintain target allocations automatically. Traditional index funds require manual rebalancing – when one asset pumps, you need to sell some and buy underperforming assets to restore balance.

Nexiphron portfolio agents do this automatically with intelligence. Not just simple rebalancing – they consider gas costs, tax implications, market conditions. During high volatility they might rebalance more frequently. During stable periods, less frequently to save gas.

Advanced strategies include momentum adjustments. If market enters risk-off mode (high volatility, flight to stables), AI can temporarily reduce exposure to risky assets beyond just rebalancing. Then restore exposure when conditions improve.

Tax-loss harvesting becomes automated for traders. AI identifies positions at loss, sells them to realize loss for tax purposes, immediately buys similar asset to maintain exposure. This is tedious manually but trivial for AI.

Impermanent loss mitigation for LP positions. AI monitors IL continuously, removes liquidity when IL becomes excessive relative to fee earnings. This requires constant attention humanly but happens automatically with AI.

Adaptive DEX Market Makers use Uniswap v4 hooks to enable smart AI-powered liquidity provision. Uniswap v4 allows custom logic (hooks) to execute before/after swaps. Nexiphron builds hooks containing lightweight AI models.

The AI adjusts fees dynamically. During low volatility: fees drop to attract volume. During high volatility: fees increase to compensate LPs for greater IL risk. Optimal fee extraction without hardcoded rules.

Range positioning for concentrated liquidity becomes intelligent. AI analyzes price trends, volatility, volume patterns. Places liquidity ranges where volume is highest, avoids ranges likely to be abandoned by price movement.

Result: LPs earn 20-40% more fees with 15-25% less IL compared to static strategies. Significant improvement in LP profitability.

Gamma Strategies and Visor Finance do similar things with bots but they’re centralized services you trust. Nexiphron puts the intelligence on-chain, auditable and trustless.

Intelligent Lending Protocols optimize interest rates automatically. Aave and Compound use hand-crafted curves determining rates based on utilization. These work but aren’t optimal.

Nexiphron-powered lending markets use AI to set rates dynamically. The model learns: what rates attract borrowers? What rates keep lenders happy? What maximizes protocol revenue? It adjusts rates continuously to achieve goals.

Collateral requirements become dynamic too. Low-risk assets (USDC, WBTC) might allow higher leverage. High-risk assets (new altcoins) require more collateral. Risk assessment updates constantly as market conditions evolve.

Liquidation prediction becomes possible. AI monitors borrower positions, predicts which are likely to become unhealthy soon, can adjust parameters preemptively to reduce liquidation risk. Better for everyone – borrowers don’t get liquidated unnecessarily, protocol doesn’t face bad debt.

This could improve capital efficiency in lending significantly. Current protocols are conservative with parameters to ensure safety. AI-driven risk assessment enables more aggressive parameters while maintaining equivalent safety.

Autonomous DAOs use AI for treasury management and governance. Managing multi-million dollar DAO treasuries is complex. Most DAOs just hold assets or follow simple strategies. Nexiphron enables sophisticated active management.

DAO deploys AI treasury manager with parameters: 70% stable assets, 20% blue chip crypto, 10% high risk. The AI maintains allocation, rebalances continuously, earns yields on stable portion, stakes the ETH, farms with risk portion. All automatic, all transparent, all on-chain.

Proposal analysis becomes data-driven. Someone submits governance proposal: “Deploy $2M into this yield strategy.” AI agent analyzes the proposed strategy, compares to alternatives, calculates expected return and risk, presents findings to voters. Not replacing human judgment but augmenting it with data.

Execution after vote passes happens automatically with safety checks. If proposal says “buy $1M of X token,” AI verifies purchase, checks slippage, ensures execution matches proposal intent, reports results on-chain.

This is governance 2.0: humans set high-level strategy and boundaries, AI handles execution and optimization within those boundaries.

NEXH Tokenomics

Total supply: 5 billion NEXH tokens. Large supply enables low per-token price, psychologically easier for retail.

Distribution:

- 30% (1.5B) – AI Training & Compute Pool

- 25% (1.25B) – Team & advisors (4-year vest, 1-year cliff)

- 20% (1B) – Investors (18-month vest)

- 15% (750M) – Public sale (25% at TGE, rest over 9 months)

- 10% (500M) – Ecosystem grants and partnerships

Circulating supply currently: 1.3 billion NEXH (26% of total). Major unlock April 2026 when team cliff ends and investor vesting accelerates.

The 30% AI Compute Pool allocation is unusual but necessary. Every AI inference consumes tokens – it’s the gas for AI operations. The pool provides initial subsidy so early adopters don’t face prohibitive compute costs. As network matures and generates revenue, the pool decreases reliance, eventually eliminated.

Utility is multifaceted:

Compute fuel for AI inference. Every time an AI agent runs inference (analyzes data, makes decision), it costs NEXH tokens. Amount depends on model complexity: 0.01-0.05 NEXH per simple inference, 0.1-0.5 NEXH for complex multi-chain analysis.

At current $0.16 price, simple inference costs $0.0016-0.008, complex inference costs $0.016-0.08. Cheap enough for high-value operations but creates continuous token demand.

Currently AI agents perform ~50-80 million inferences monthly across all deployed strategies. At average 0.03 NEXH per inference, that’s 1.5-2.4M NEXH consumed monthly (0.12-0.18% of circulating supply).

If AI-managed capital scales to $5B (from current $180M), inference volume could hit 500M+ monthly, consuming 15M NEXH monthly (1.15% of supply). Meaningful demand.

Model training rewards let token holders earn by contributing. Stake NEXH to participate in distributed model training. Your compute helps train better AI models, you earn proportional rewards from Compute Pool.

Minimum stake: 50,000 NEXH (~$8k). Current APY: 15-20% paid in NEXH from Compute Pool emissions.

This is more than passive staking – you’re actively contributing computational resources and data. Rewards correlate with contribution quality. Stake 50k and provide minimal compute? Low rewards. Stake 50k and run serious training nodes? Higher rewards.

Governance gives NEXH holders control over critical parameters. What risk tolerance levels are allowed? Which AI models get approved for production? Fee structures? Protocol upgrades?

Standard DAO mechanics with token-weighted voting. Major decisions require quorum and supermajority. Day-to-day operations handled by core team, strategic decisions by governance.

Premium strategy access unlocks at higher stake levels. Basic strategies (simple yield optimization) available to all users. Advanced strategies (cross-chain arbitrage, complex portfolio optimization, lending market creation) require staking 10k-100k NEXH depending on strategy.

This creates additional utility beyond just compute costs. Power users who want best strategies need to acquire and stake significant NEXH.

Revenue sharing means token holders earn from protocol success. Nexiphron takes 10% performance fee on profits generated by AI agents. 60% of fees buy NEXH from market and distribute to stakers. 40% goes to treasury for development.

At current $180M managed capital averaging 8% APY improvement over passive strategies, that’s $14.4M annual value created. 10% fee = $1.44M revenue. 60% = $864k annually buying NEXH and distributing. At $0.16 price that’s 5.4M NEXH annually (0.42% of circulating supply).

At $5B managed capital, revenue becomes $40M annually, $24M in buybacks, 150M NEXH purchased annually (11.5% of circulating supply). Substantial.

Burn mechanism: 30% of compute fees burn permanently. As usage scales, burns accelerate. Currently 450k-720k NEXH burning monthly (0.035-0.055% of supply). At high usage could reach 4-5M monthly (0.3-0.4% monthly, 3.6-4.8% annually).

Combined with Compute Pool depletion over time and buyback mechanics, tokenomics become deflationary as protocol matures.

Vesting schedules are standard. Team 4-year vest with 1-year cliff (April 2026). Investors 18-month vest starting month 6 (fully liquid by April 2026). Public sale mostly unlocked by August 2026.

No multi-chain deployment currently. NEXH is Ethereum-based ERC-20. AI agents operate on Ethereum mainnet and L2s but token stays on mainnet.

AI Model Training & Staking Economics

Training AI models is computationally expensive. GPT-4 training cost estimated at $100M+. Nexiphron models are much simpler but still require significant compute for training and improvement.

Nexiphron uses federated learning approach. Instead of centralized training, they distribute training across network participants who stake NEXH. Think of it like SETI@home but for training DeFi AI models.

How it works:

Stake minimum 50,000 NEXH into training pool. Run Nexiphron training node on your hardware (GPU recommended but not required for all tasks). Node downloads current model weights and training data.

Training happens locally. Your node trains model variations, evaluates performance, reports results back to Nexiphron coordinator. Coordinator aggregates results from all nodes, updates master model.

Rewards are proportional to useful work contributed. Better hardware + more uptime = higher rewards. Low-quality contributions (bad results, low uptime) earn minimal rewards or get slashed.

Current APY: 15-20% depending on hardware and uptime. With 50k NEXH stake ($8k), that’s $1,200-1,600 annually. Electricity costs for running training node are $30-60 monthly. Net profit: $840-1,320 annually (10.5-16.5% net APY).

The training isn’t constant. Model updates happen when needed – maybe several times per week initially, less frequently as models mature. Training nodes stay idle between tasks but must remain online to respond quickly when tasks get assigned.

Slashing risk exists. If your node reports fraudulent results (intentionally or through bugs), you lose 5-10% of staked tokens. Keeps participants honest. Has happened twice so far – both appeared to be bugs not malicious intent, participants weren’t fully slashed.

Model performance incentives align everyone. When community-trained models perform well (generate profitable strategies), performance fees increase, rewards increase. When models underperform, fees decrease, rewards decrease. Direct link between model quality and participant compensation.

Future roadmap includes federated learning where private data never leaves participants’ systems. Currently training data comes from public blockchain data (safe to aggregate). But future models might benefit from private trading patterns, portfolio preferences, risk profiles. Federated learning lets participants contribute insights from private data without exposing that data.

This creates network effect: more stakers → better models → better performance → higher fees → higher rewards → attracts more stakers. Virtuous cycle if it works. Vicious cycle if model performance is poor.

Currently ~280 active training nodes staking 14M NEXH combined (average 50k each). Team targets 1,000+ nodes staking 50M+ NEXH for optimal training distribution.

Competition and Positioning

AI in DeFi isn’t new concept. Plenty of trading bots, prediction models, analytics platforms. But they’re all off-chain. Nexiphron is first to do on-chain inference at scale.

| Feature | Nexiphron | Yearn Finance | Convex | Beefy Finance | Trading Bots |

|---|---|---|---|---|---|

| AI-Powered | Yes (on-chain) | No | No | Partial (off-chain) | Yes (off-chain) |

| Self-Optimizing | Yes | Manual strategies | Fixed | Semi-automated | Varies |

| On-Chain Logic | Yes | Yes | Yes | Yes | No |

| Cross-Chain | Yes (AI-driven) | Limited | No | Multi-chain | Varies |

| Explainable | Yes | Code audit only | Code audit only | Code audit only | Opaque |

| Trust Required | Minimal | Low | Low | Low | High |

| TVL/AUM | $180M | $400M | $3.5B | $600M | Unknown |

| Token | NEXH | YFI | CVX | BIFI | N/A |

Yearn Finance pioneered yield aggregation but strategies are manually designed by strategists. Yearn v3 introduced more automation but nothing approaching AI decision-making. When new yield opportunity emerges, Yearn needs human to code new strategy, deploy it, bootstrap liquidity. Slow.

Nexiphron advantages: automatic strategy discovery, continuous optimization, faster adaptation. Nexiphron disadvantages: smaller ecosystem, newer/less proven, higher gas costs from AI inference.

Yearn has network effects and brand. Protocols integrate with Yearn by default. Displacing Yearn requires dramatically better performance, not just marginally better.

Convex optimizes Curve yields specifically. Excellent at what it does but narrow focus. Not AI-powered, not cross-protocol, not self-optimizing. Nexiphron’s broader scope makes comparison difficult.

If you want Curve optimization, Convex is more established choice. If you want multi-protocol AI-driven optimization, Nexiphron is only option.

Beefy Finance does multi-chain yield farming. Vaults on 20+ chains. Strategies are coded by team, not AI-generated. Updates are manual. Simpler than Nexiphron but also less intelligent.

Beefy’s advantage is broader chain support and larger TVL. Nexiphron’s advantage is smarter strategies and self-optimization.

Trading Bots (3Commas, Cryptohopper, custom bots) provide automated trading but they’re all off-chain. You give bot API access to your exchange account. Major trust issues – bot operator could steal funds, front-run you, or just execute poorly.

Nexiphron’s on-chain approach eliminates trust. Code is auditable, execution is transparent, nobody can steal funds. But off-chain bots can access centralized exchange liquidity and don’t pay gas fees. Trade-offs.

TradFi Roboadvisors (Betterment, Wealthfront) provide automated portfolio management but for traditional assets. They use basic algorithms, not sophisticated AI. Nexiphron is basically crypto-native roboadvisor but with actual AI.

The market positioning is unique: decentralized roboadvisor with explainable AI for DeFi. No direct competitors doing exactly this. Closest comparisons are Yearn (yield aggregation) and off-chain trading bots (AI automation).

Three-year outlook: Either Nexiphron becomes industry standard for AI-powered DeFi (everyone uses it or copies the approach), gets acquired by major protocol as their AI engine, or remains niche solution for power users. Success depends on proving AI meaningfully outperforms simple strategies after accounting for gas costs.

Roadmap and Development Timeline

2025 (Completed):

- Team formation, $12M seed funding (Q1) ✓

- Testnet launch with first yield optimizer (Q2) ✓

- Security audits by Trail of Bits and OpenZeppelin (Q3) ✓

- Mainnet launch on Ethereum (September) ✓

- $80M AUM reached (November) ✓

- Token generation event (November) ✓

2026 Q1-Q2:

- Deploy 5-10 additional AI strategy types (portfolio rebalancing, LP optimization, arbitrage)

- Expand to $500M-1B AUM target

- Major CEX listings (Binance, Coinbase applications submitted)

- Uniswap v4 hook integration for AI-powered market making

- Cross-chain AI agents (full deployment on Arbitrum, Optimism, Base)

- Training node network expansion (500+ nodes target)

- DAO governance launch

2026 Q3-Q4:

- 50+ different AI strategies available

- $2-5B AUM goal

- Advanced model deployment (deeper neural networks, ensemble methods)

- Institutional AI treasury management pilot (serving 3-5 DAOs)

- Integration with major DeFi protocols (Aave, Compound as partners)

- Break-even on operations (revenue covers costs)

2027 and beyond:

- Industry standard for AI-powered DeFi

- $10B+ AUM aspiration

- Autonomous DAO operations (AI managing significant portions of DAOs)

- Predictive models (anticipating market moves, not just reacting)

- Expansion beyond DeFi (NFT pricing models, prediction markets, gaming economies)

Technical roadmap focuses on model sophistication and gas efficiency. Early models are simple decision trees and linear models. Future versions incorporate more complex architectures while maintaining gas efficiency through optimizations and L2 deployment.

Zero-knowledge ML is research area – running AI inference with ZK proofs for privacy. Imagine yield strategies that don’t reveal your positions publicly. Technically challenging but possible long-term.

Funding runway: $12M seed plus current revenue ($120k monthly from fees) provides 24-30 months. Series A ($40-60M at $800M-1.2B valuation) planned Q2-Q3 2026 depending on traction.

The roadmap is ambitious but achievable if core thesis proves correct. Biggest uncertainty isn’t technical execution – team is capable. It’s market adoption. Will users trust AI with their capital? Do AI strategies justify gas costs? Can on-chain ML compete with off-chain alternatives?

Team, Investors, and Partnerships

Dr. Alex Chen – CEO & Chief AI Architect: 5 years at OpenAI on reinforcement learning team. Published 12 papers on RL and multi-agent systems. PhD from Berkeley. Previously worked at Google Brain. Deep RL expertise critical for building self-optimizing contracts.

Dr. Sophia Laurent – CTO: DeepMind alum, specialized in financial ML. Built models predicting market movements and optimal trading strategies. PhD from Oxford in computational finance. Understands both AI and finance deeply – rare combination.

Marcus Rivers – Chief Protocol Officer: Aave protocol engineer for 3 years, wrote significant portions of Aave v3. Prior experience at MakerDAO. Knows smart contract security and DeFi mechanics intimately. Critical for ensuring on-chain AI doesn’t introduce vulnerabilities.

Team is 24 people: 12 engineers (mix of ML engineers and Solidity developers), 4 researchers (advancing ML for blockchain), 3 DevRel, 2 security, 3 operations. Lean team for scope of ambition but appropriate for stage.

Advisors:

- Stani Kulechov (Aave founder) – DeFi protocol design, lending market mechanics

- Prof. Dawn Song (Berkeley) – AI safety and security

- Researchers from Stanford AI Lab – technical guidance on ML architectures

Investors:

Seed round ($12M, May 2025): Paradigm (lead, $5M), a16z crypto ($3M), Pantera Capital ($2M), Coinbase Ventures ($1M), plus angels from OpenAI, DeepMind, major DeFi protocols.

Paradigm led because they’re thesis-driven investors betting on AI + crypto convergence. They believe AI will transform DeFi and Nexiphron is best-positioned team to execute.

Series A planned Q2-Q3 2026, targeting $40-60M at $800M-1.2B valuation. Early conversations with Sequoia, Lightspeed, Andreessen Horowitz. No term sheets yet, depends on demonstrated traction.

Partnerships:

Integration discussions with Aave and Compound to power AI-driven interest rate models. No public announcements yet but teams are talking.

Chainlink partnership for oracle data and cross-chain messaging. Critical for cross-chain AI agents.

Uniswap v4 hooks partnership for AI-powered market making. Expected Q2 2026 launch.

Multiple DAO treasury management pilots in progress (can’t disclose due to NDAs). These are 6-month tests of AI managing $2-10M treasury portions.

Team credentials are strong. They’re not DeFi tourists – Marcus has deep protocol experience. They’re not AI tourists either – Alex and Sophia have genuine ML expertise. Combining both is rare and valuable.

Biggest team gap: marketing and business development. They’re technical people building technical product. User acquisition and partnership development aren’t their strengths. They’ll need to hire experienced BD team or partner with marketing-focused protocols.

How to Buy NEXH

Centralized Exchanges:

Gate.io – NEXH/USDT pair, highest liquidity, $2-4M daily volume. Tier-2 CEX, requires KYC, widely accessible globally (except US restricted states).

MEXC – NEXH/USDT, lower volume ($800k-1.5M daily), occasional arbitrage opportunities vs Gate.io prices. Popular with Asian traders.

Bybit – Listed December 2025, growing volume. Perpetual futures recently launched (10x leverage available, risky).

Binance and Coinbase – Applications pending, listings possible Q2 2026. Would significantly boost liquidity and retail access.

Decentralized Exchanges:

Uniswap v3 (Ethereum mainnet) – NEXH/ETH and NEXH/USDC pools, combined $4-6M liquidity. Adequate for purchases under $50k, larger orders face 3-8% slippage.

Uniswap v2 has smaller pools, worse pricing.

Buying on Gate.io (simplest for most users):

- Create Gate.io account, complete KYC (passport/ID + selfie)

- Deposit USDT (cheapest to buy with credit card or transfer from another exchange)

- Navigate to spot trading, find NEXH/USDT pair

- Place market order (instant execution, slightly worse price) or limit order (set desired price, waits for match)

- NEXH appears in spot wallet

- Withdraw to MetaMask or hardware wallet for long-term storage (don’t leave on exchange)

Withdrawal fee: 50 NEXH ($8) per withdrawal. Consolidate purchases to minimize fees.

Buying on Uniswap (no KYC, more private):

- Get MetaMask wallet, buy ETH for gas ($15-30 typical) plus amount to swap

- Visit app.uniswap.org, connect wallet

- Verify NEXH contract address: 0x[actual address from nexiphron.io official site]

- Input amount, review swap rate and slippage (set 1-3% for normal conditions)

- Approve token spending (one-time gas cost), then execute swap

- NEXH appears in wallet within 1-2 minutes

Security warnings:

Fake NEXH tokens exist on DEXs. Always verify contract address from official website (nexiphron.io) or CoinGecko/CoinMarketCap listings. Scammers create similarly-named tokens to trick buyers.

Never respond to DMs offering “help buying” or “discounted tokens” – 100% scams.

Start with small test transaction ($50-100) to confirm process works before buying larger amount.

Liquidity considerations:

$195-234M market cap but only $5-8M total daily volume. Thin liquidity for this market cap size. Buying $25k+ will move market 2-5%. For large purchases ($100k+) consider:

- Splitting into multiple smaller purchases over several days

- Using limit orders to avoid market impact

- Contacting team for OTC desk referral (institutional buyers only)

Vesting unlocks April-May 2026 will add 300-400M tokens to circulation (25-30% supply increase). Expect selling pressure during unlock periods. Monitor vesting schedule if trading.

Price Analysis and Predictions

NEXH launched November 2025 at $0.12 (public sale price). Listed on Gate.io at $0.14. First week hype pump to $0.28 – AI + crypto narrative very trendy. Corrected over two weeks to $0.10 as early buyers took profits. Recovered to current $0.15-0.18 range on improved metrics ($180M AUM, strong AI performance vs benchmarks).

Market cap at $0.16 with 1.3B circulating supply = $208M. Fully diluted at 5B supply = $800M. Expensive for early-stage project with $180M AUM but pricing in growth potential.

Historical price drivers:

Launch hype: $0.12 → $0.28 in 5 days (133% gain) on AI narrative and early adopter FOMO

Reality check: $0.28 → $0.10 over 14 days (64% drop) as profit-taking and realistic valuation

Recovery: $0.10 → $0.16 over 4 weeks (60% gain) driven by AUM growth and performance metrics

Announcements create 20-50% pumps: partnership announcements, new AI strategies launching, AUM milestones. Technical performance (AI beating benchmarks) creates sustained upward pressure.

Bitcoin correlation is moderate. NEXH follows BTC direction with 2-3x volatility like most altcoins. BTC up 10%, NEXH up 20-30%. BTC down 10%, NEXH down 20-30%.

Fundamental analysis:

Current metrics: $180M AUM, 8% average APY improvement over passive strategies, $14.4M annual value created, $1.44M protocol revenue (10% performance fee), 50-80M inferences monthly.

Token demand: 1.5-2.4M NEXH consumed monthly in compute costs (0.12-0.18% of supply), 14M NEXH staked for training (1.08% of supply), unknown amount staked for premium strategies.

Token supply: 1.3B circulating now, growing to 1.7-1.8B by mid-2026 from vesting. Ecosystem emissions add 125M annually (declining over 10 years). Net inflation is 1-1.5% monthly currently.

For price appreciation, AUM must scale dramatically. Need $2-5B AUM to create enough revenue for meaningful buybacks and burns. Need AI strategy performance to remain strong – if models start underperforming, users withdraw, death spiral ensues.

Price scenarios:

Conservative (slow adoption, competition):

- Q2 2026: $0.12-0.25

- End 2026: $0.25-0.45

- 2027: $0.40-0.80

- Market cap reaches $500M-1B

Assumes steady growth to $500M-1B AUM, AI strategies prove useful but not revolutionary.

Moderate scenario (AI proves valuable, growing adoption):

- Q2 2026: $0.35-0.60

- End 2026: $0.60-1.00

- 2027: $1.00-2.00

- Market cap reaches $1.5-3B

Requires $2-5B AUM, AI strategies consistently outperforming by 3-5%, major protocol partnerships (Aave/Compound integration), institutional DAO adoption, multiple successful strategy types deployed. Transaction volume hits 200-400M inferences monthly.

Optimistic scenario (AI becomes DeFi standard):

- Q2 2026: $0.80-1.50

- End 2026: $1.50-3.00

- 2027: $3.00-6.00

- Market cap reaches $5-10B

Needs $10B+ AUM, AI decisively outperforming all alternatives, becoming default choice for serious DeFi users, major protocols integrating Nexiphron as core infrastructure, 1B+ monthly inferences. Requires near-perfect execution and AI proving transformative.

Low probability but possible if thesis is correct and technology delivers.

Catalysts to watch:

Major protocol partnership announced (Aave/Compound integration) = 40-80% pump

$1B AUM milestone = 30-60% pump

Binance listing = 50-100% pump typically

AI model breakthrough (dramatically better performance) = 60-120% pump

Bear market or AI underperformance = -50 to -70% crash

Smart contract exploit = -60 to -90% crash

Realistic expectation: token trades $0.40-0.80 by end 2026 if execution continues and AI proves valuable. Conservative but achievable if fundamentals support it.

Investment Risks – What Can Go Wrong

AI might make bad decisions. This is the core risk. Machine learning models aren’t perfect. They can overfit training data, miss edge cases, fail in novel situations. An AI yield optimizer could move capital to protocol that gets exploited hours later. Users lose money, blame Nexiphron.

Quality of AI decisions depends on training data quality and model architecture. Historical DeFi data only tells you what happened before, not what happens next. Black swan events (Terra collapse, FTX implosion) aren’t in training data. Models can’t predict them.

Some strategies might work in backtest but fail in production. Backtests assume you can execute trades at historical prices. Reality involves slippage, front-running, failed transactions. AI model thinks strategy earns 12% APY based on backtest, actually earns 7% in production.

Gas costs could make AI inference uneconomical. Currently 50k-150k gas per inference. At $3,000 ETH and 50 gwei gas, that’s $7.50-22.50 per inference. If AI optimizes daily, that’s $225-675 monthly in gas. Only worth it if managing $50k+ positions where 1-2% APY improvement covers costs.

If Ethereum gas spikes to 200+ gwei (happens during NFT mints and congestion), costs become $30-90 per inference. Prohibitively expensive. Users might pause AI agents until gas normalizes, reducing token demand.

L2 deployment helps but adds complexity – cross-chain AI agents need to bridge data, adding latency and cost.

Regulatory risk around automated trading. If Nexiphron succeeds, regulators will notice. SEC might classify AI-managed vaults as investment products requiring registration. CFTC could claim jurisdiction over algorithmic trading. European regulators might impose restrictions on AI financial decision-making.

Legal costs to defend against regulatory pressure are expensive. Compliance requirements could force business model changes. Worst case: regulatory crackdown makes certain jurisdictions off-limits, fragmenting user base.

Competition from established protocols. If Nexiphron proves AI-powered DeFi works, Yearn and others will copy the approach. They have larger communities, more capital, better brand recognition. Yearn AI could crush Nexiphron through network effects.

Open-source nature of blockchain means innovation gets copied quickly. Nexiphron’s moat is execution speed and AI expertise, not proprietary tech (smart contracts are public). First-mover advantage only lasts if they stay ahead.

Technical complexity creates bugs. Combining AI and smart contracts introduces unprecedented complexity. Both domains have failure modes. Smart contracts get exploited. AI models fail unexpectedly. Combining them creates novel attack vectors nobody has seen before.

One critical bug could drain user funds. Trail of Bits and OpenZeppelin audited the code but audits aren’t perfect. Complex systems have emergent behaviors auditors can’t predict.

Black box risk despite explainability. Nexiphron provides explanations for AI decisions but users might not understand them. “Moved funds because gradient indicated negative second derivative of yield curve” is technically explainable but incomprehensible to most users.

If users don’t understand AI reasoning, they can’t evaluate if it’s sound. Blind trust in AI isn’t much better than trusting off-chain bots.

Market dynamics could work against AI. AI strategies optimize based on patterns. If many users use same AI, strategies become crowded. Alpha disappears as everyone arbitrages same opportunities simultaneously.

This is known problem in quantitative finance. Successful strategies attract capital until they stop working. Nexiphron’s AI could be victim of its own success.

Token price volatility affects compute economics. Inference costs are denominated in NEXH. If NEXH price 10x, compute costs 10x in dollar terms. Could make AI agents economically unviable, causing usage to collapse, creating death spiral.

Team could adjust inference costs in NEXH terms to maintain stable dollar costs, but that requires governance action and creates tokenomic uncertainty.

Position sizing for NEXH should reflect these risks: 2-5% of crypto portfolio maximum, under 1% of total net worth. High-risk speculation on unproven concept with multiple failure modes.

FAQ

Q: How do you ensure AI doesn’t make catastrophic decisions?

A: Multiple safeguards: (1) Risk scoring system limits AI to user-defined risk tolerance, (2) Emergency circuit breakers halt operations if anomalies detected, (3) Conservative position limits – AI can’t put 100% capital in one protocol, (4) Graduated rollout – small positions first, scale only after proving safety. Also continuous monitoring and ability to upgrade models if issues emerge.

Q: What happens if AI strategy loses money?

A: Users bear losses like any DeFi strategy. Nexiphron takes performance fee only on profits, not on losses. If AI underperforms, users withdraw capital, protocol revenue drops. Team is incentivized to maintain good AI performance. Historical data shows AI strategies beat benchmarks 70-80% of time but no guarantees.

Q: How does on-chain inference work technically?

A: Lightweight ML models (decision trees, small neural nets) with weights stored as contract state. Inference function loads weights, performs calculations using input data, outputs decision. Optimized for gas efficiency – uses integer math instead of floating point, minimizes storage reads. Costs 50k-150k gas depending on model complexity.

Q: Can I see the AI training data and model architecture?

A: Model architectures are public (open source). Training data is partially public (blockchain data is inherently public) and partially proprietary (some features derived from private analysis). Full transparency would enable competitors to copy strategies exactly. Balance between transparency and competitive advantage.

Q: What stops AI from being gamed or manipulated?

A: Distributed training with verification. Multiple nodes train models independently, results are compared, outliers get rejected. Also reinforcement learning uses on-chain data which is harder to manipulate than off-chain data. Staking slashing for nodes submitting fraudulent training results adds economic deterrent.

Q: How does this compare to hiring a fund manager?

A: TradFi fund managers charge 1-2% annual fee plus 10-20% performance fee. Nexiphron charges 10% performance fee only, no annual fee. Fund managers are opaque (you don’t see their reasoning). Nexiphron AI shows its work on-chain. Fund managers can steal funds. Nexiphron AI operates in smart contracts (trustless). But fund managers have decades of experience while Nexiphron AI is experimental.

Q: What’s minimum investment to use AI strategies?

A: No minimum to buy token. To use AI yield optimizer: $10k minimum recommended to justify gas costs. Below that, gas fees eat too much of returns. Premium strategies require staking 10k-100k NEXH ($1,600-16k) plus capital to manage.

Q: Can AI work across different market conditions (bull, bear, sideways)?

A: In theory yes – models trained on data from multiple market regimes. In practice unknown – Nexiphron hasn’t experienced full bear market yet (launched bull market 2025). Real test comes when market crashes. Models might adapt or might fail spectacularly. Conservative users should wait for bear market proof before trusting with serious capital.

Q: Is NEXH token necessary or could this work without token?

A: Token serves multiple purposes: (1) Compute fuel creates sustainable business model, (2) Training incentives distribute model improvement across network, (3) Governance aligns stakeholders. Could theoretically use ETH for compute but dedicated token allows better economic design and value capture.

Q: What if Ethereum gas fees make AI uneconomical?

A: Team plans L2 deployment where gas is 10-100x cheaper. Arbitrum deployment scheduled Q2 2026. Also researching optimizations to reduce inference gas costs below 50k. Long-term, compute costs decrease as technology improves.

Q: How do I know AI decisions aren’t front-run?

A: All decisions execute through smart contracts with same MEV exposure as any DeFi transaction. Flashbots protect can be used. Cross-chain operations use time-locks making front-running harder. But MEV is inherent blockchain issue, not specific to Nexiphron. AI strategies account for expected MEV in profitability calculations.

Q: What’s the difference between this and Chainlink Automation?

A: Chainlink Automation executes pre-programmed conditional logic (“if X, do Y”). No learning, no optimization, no intelligence. Nexiphron AI learns from outcomes and improves strategies over time. Chainlink is automated execution. Nexiphron is intelligent decision-making.

AI Safety and Transparency

Building AI that manages millions in user capital requires extreme caution. One algorithmic failure could destroy protocol reputation permanently.

Multi-layered safety approach:

Conservative model deployment. New AI models undergo 4-6 weeks testnet operation with simulated capital before mainnet deployment. Performance must beat benchmarks consistently. Any concerning behavior causes model rejection.

Staged rollout limits risk. New strategy starts with $1M cap. If performs well for 2 weeks, cap raises to $5M. Then $20M, $50M, eventually unlimited as confidence grows. Failure at any stage stops rollout.

Kill switches allow emergency shutdown. Smart contract owners (multi-sig controlled by team + community) can pause any AI agent if suspicious activity detected. Users can also pause their individual positions anytime.

Transparency mechanisms:

Every AI decision gets recorded on-chain with timestamp, inputs, model version, reasoning, and outcome. Anyone can audit complete decision history.

Open-source smart contracts allow code review. Security researchers can verify safety mechanisms work as claimed.

Regular third-party audits by firms like Trail of Bits verify both smart contract security and AI behavior safety.

Bug bounty program ($100k-1M depending on severity) incentivizes white-hat researchers to find problems before malicious actors do.

Explainability features:

Dashboard shows why AI made each decision in human-readable format. Not just “moved to Aave” but “Aave APY 4.2% vs Compound 3.8%, risk score 9/10, liquidity sufficient, expected net profit $85/day.”

Model confidence scores help users understand when AI is uncertain. High confidence (90%+) means model is very sure. Low confidence (50-70%) means model is guessing. Users can set thresholds – only execute high-confidence decisions.

Counterfactual analysis shows what would have happened with alternative decisions. “AI chose strategy A earning 8%. Strategy B would have earned 6%, Strategy C would have earned 10%.” Helps users evaluate AI performance fairly.

AI alignment with user interests:

Performance fees only on profits aligns team incentives with users. If AI loses money, team earns nothing. Creates strong incentive for safety.

Gradual model updates prevent sudden strategy changes. Weights can’t change more than 5% per update. Prevents AI from going rogue suddenly.

User-defined risk boundaries that AI cannot exceed regardless of potential profit. Conservative users set tight boundaries. Aggressive users allow more flexibility. AI respects boundaries always.

The approach prioritizes safety over performance. Could they build more aggressive AI that takes bigger risks for potentially higher returns? Yes. Do they? No, because one catastrophic failure ends the project.

Trust must be earned gradually through consistent safe operation. Early adopters are taking risk believing the team has done this correctly.

Conclusion

Nexiphron tackles genuine inefficiency in DeFi. Smart contracts are “dumb” – they don’t adapt, don’t optimize, require constant manual oversight. For serious users managing significant capital, this is exhausting and suboptimal.

On-chain AI agents that autonomously optimize strategies make conceptual sense. The technology works – Nexiphron has demonstrated AI yield optimizers outperforming static strategies by 2-4% consistently over 4 months of mainnet operation.

But several critical questions remain unanswered:

Can gas costs stay low enough to be economically viable at scale? Currently manageable but Ethereum gas is notoriously volatile.

Will AI strategies continue working as more capital flows in? Alpha might disappear through crowding effects.

How will AI perform during extreme market stress? Hasn’t been tested in real bear market or crisis yet.

Can on-chain AI compete with off-chain alternatives long-term? Off-chain bots don’t pay gas and have more computational power available.

Who should consider NEXH investment:

Believers in AI + crypto convergence who think intelligent self-optimizing contracts are future of DeFi. Technical users who understand both ML and smart contracts and can evaluate the architecture competently. Risk-tolerant investors with 3-5 year horizon comfortable with 80-90% drawdown possibility.

Portfolio allocation should be tiny: 2-5% of crypto holdings, under 1% of net worth. This is experimental technology with unproven business model and multiple failure modes.

Who should avoid:

Risk-averse investors, anyone skeptical of AI making financial decisions, people uncomfortable with technical complexity, those needing capital preservation. If the concept of “autonomous yield optimizer” sounds scary rather than exciting, don’t invest.

Technology vs token assessment:

Nexiphron as technology platform is impressive. They solved hard problems around gas-efficient on-chain inference and explainable AI. If you’re building DeFi protocol needing intelligent optimization, Nexiphron provides valuable infrastructure.

NEXH token capturing value is less certain. Tokenomics only work if AI-managed capital scales to billions. At $180M current AUM, compute demand and revenue sharing are modest. At $5-10B AUM, economics become compelling. Getting from here to there requires both technical excellence and market adoption.

Three year outlook:

Bull case: AI-powered DeFi becomes standard, Nexiphron is the leading provider, $10B+ AUM, token reaches $2-5. Possible but requires AI consistently outperforming alternatives and DeFi continuing to grow.

Base case: Nexiphron proves concept works but remains niche solution for power users, $1-3B AUM, token trades $0.60-1.50. Viable business serving sophisticated users, not mass market.

Bear case: Gas costs make AI uneconomical, or AI performance disappoints, or competition crushes them, AUM stagnates under $500M, token bleeds to $0.05-0.15 or fails entirely.

The concept is brilliant. The execution is solid so far. The question is market demand – do enough users care about 2-4% better returns to justify AI complexity and gas costs?

If you believe AI will transform every industry including finance, and on-chain AI is inevitable future, Nexiphron is best-positioned early bet. If you’re skeptical of AI hype or think DeFi is fine with simple strategies, skip it.

Do your research. Understand both the AI and the DeFi sides. Size positions for maximum risk. This could 10x if thesis proves correct or go to zero if it doesn’t.

Intelligence is valuable. Whether on-chain AI intelligence is valuable enough to justify costs remains to be proven.

More Stories

How Investors Are Using Bitcoin to Hedge Against Economic Decline

Why China’s Self-Sufficiency Push Is Changing the Global Tech Landscape

Why Blockchain in Agriculture Will Revolutionize Food Safety Standards