In today’s volatile financial landscape, discerning between Bitcoin vs Gold has become critical for investors. Understanding economic indicators can empower investors to make informed decisions about which asset class to support, reflecting broader economic sentiments and their implications for the future.

Importance of Economic Indicators in Investment Choices

Economic indicators serve as vital signals for market trends and sentiments, guiding investor decisions in the Bitcoin vs Gold debate. These indicators, such as unemployment rates, inflation figures, and GDP growth, provide insights into the economy’s direction. For instance, rising inflation may lead investors to seek refuge in gold, traditionally seen as a hedge against currency devaluation. According to recent reports, inflationary pressures have made gold attractive amid concerns of economic instability (BeInCrypto).

Conversely, Bitcoin’s value often correlates with positive economic outlooks and technological adoption. Historical data reveals that during bullish market phases, Bitcoin tends to outshine traditional assets, reflecting a speculative approach that capitalizes on perceived future growth potential. Therefore, understanding these economic indicators becomes essential in assessing which asset could flourish under varying economic scenarios, ultimately impacting their valuations.

Bitcoin vs Gold: Two Opposing Economic Views

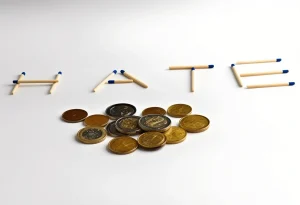

The perspectives surrounding Bitcoin vs Gold shed light on their distinct economic implications. Bitcoin is often viewed as a modern asset class reflective of optimism toward economic reforms and the technology-driven future. In contrast, gold is synonymous with caution, embodying skepticism about economic sustainability and fiscal responsibility. Market strategist James E. Thorne encapsulated this sentiment, stating, “For the record. Bitcoin is a bet on Trump’s success. Gold is a bet on America’s failure” (BeInCrypto).

This dichotomy in investor outlook is critical when assessing asset allocation. As investors align their portfolios, understanding whether they lean toward the optimism encapsulated by Bitcoin or the safety inherent in gold can significantly guide their investment choices. Preferences can also be influenced by external economic policies, making it increasingly important to evaluate these contrasting views regularly.

Current Market Trends in Crypto Assets

Recent market movements indicate varied trajectories for Bitcoin and gold, influenced largely by upcoming fiscal policies. With central banks adjusting interest rates and monetary supply, investor behavior reflects both caution and speculation. For example, Bitcoin saw significant fluctuations earlier this year, driven by market responses to regulatory announcements (Yahoo Finance). As a result, the asset class demonstrated heightened volatility in investor engagement.

In comparison, gold remains a more stable asset during economic uncertainty, attracting traditional investors seeking to preserve capital. This trend reveals how changing economic policies can impact market performance differently for cryptocurrency and commodity assets, leading to strategic shifts among investors. Observing and analyzing these trends allows investors to adapt their strategies appropriately.

The Role of Investor Sentiment in Asset Choices

Investor sentiment plays a crucial role in shaping investment strategies in the Bitcoin vs Gold discourse. Emotional and psychological factors often dictate asset preference, leading to erratic market behaviors. Surveys and studies indicate that bullish sentiment surrounding Bitcoin can lead to increased investments, while prevailing pessimism about the economy may drive investors toward gold.

In essence, understanding these psychological nuances helps in predicting market movements and adjusting investment portfolios accordingly. Insights from the market suggest that mood swings, driven by news cycles or economic developments, have a substantial impact on investor behavior, further complicating the decision to favor either asset class. Analyzing these aspects can provide a clearer view of how sentiment interplays with economic indicators to influence investment choices.

Strategies for Assessing Economic Indicators

To effectively navigate the complex Bitcoin vs Gold investment landscape, investors can utilize various methods for analyzing economic data. Key strategies include:

– Regular Monitoring: Keeping an eye on prominent economic indicators such as inflation rates, GDP growth, and unemployment statistics.

– Utilizing Technology: Employing economic analysis tools and software to track relevant indicators in real-time.

– Consulting Experts: Following insights from financial analysts and reports helps gauge the relationship between economic indicators and asset performance.

By aligning individual investment choices with economic signals, investors can make more informed decisions. The integration of these strategies not only enhances awareness of market trends but also bolsters confidence when navigating potential investments.

Future Considerations for Bitcoin and Gold Investments

Looking ahead, the evolving landscape for both Bitcoin and gold presents unique challenges and opportunities. As economic policies continue to shift, investors must remain adaptable to changing conditions. For Bitcoin, developments in regulatory frameworks and technology adoption could dictate its future value, while gold may stabilize or rise amid market turbulence as a safe-haven asset.

Adaptation might involve diversifying portfolios or reallocating resources based on emerging economic data and trends. Investors should remain proactive in analyzing economic indicators and understanding their implications for both asset classes, ensuring they are prepared for potential future fluctuations in the market.

More Stories

Why Bitcoin’s Recent Price Drop Is Impacting the Entire Crypto Market

What No One Tells You About Bitcoin’s Risky Market Position

Why Ethereum Outflows Could Change the Game for Crypto Investors