As the crypto economy shifts in 2026, understanding Bitcoin sentiment is crucial for investors. With significant market fluctuations and historical fears displayed in metrics like the Fear and Greed Index, we need to grasp why now is a pivotal moment for Bitcoin enthusiasts.

Understanding Bitcoin’s Current Sentiment

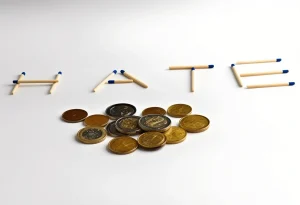

Bitcoin sentiment has taken a notable plunge, reflecting a landscape filled with market fear. Recent reports indicate that the Crypto Fear and Greed Index has recently hit an extreme low, numbering around 10 out of 100. This typically signals widespread caution among investors, suggesting a different kind of anxiety in the market. However, as history has shown, such levels of fear can often signal a market reversal, posing a potential buying opportunity for savvy investors. Despite the rising fears, long-term holders are still accumulating Bitcoin. This behavior points to an underlying optimism in the market, as these investors often view price declines as advantageous moments to bolster their holdings. Such accumulation might contradict the prevailing sentiment, suggesting a structurally bullish outlook for Bitcoin in the long run, as noted in recent analysis.

Key Factors Influencing Bitcoin’s Market Sentiment

Several key factors currently influence Bitcoin’s market sentiment and investor confidence. One significant concern is the escalating U.S. federal debt, projected to reach $64 trillion within the next decade, as highlighted by the Congressional Budget Office. This dramatic increase raises questions about the U.S. dollar’s stability and its impact on Bitcoin’s appeal as an alternative asset. Additionally, the fiscal challenges faced by the Federal Reserve create uncertainty for investors. As interest rates potentially rise, many are turning to hard assets, like Bitcoin, as a safe haven in this precarious economic climate. This demand amid fiscal instability indicates that Bitcoin could be viewed increasingly as a hedge against economic turmoil, according to insights from the Financial Times.

The Role of the Fear and Greed Index

The Fear and Greed Index plays a pivotal role in assessing Bitcoin’s market sentiment. It measures various factors, including volatility, market momentum, and Google Trends. Currently, the index reflects a heightened level of caution among investors. This low reading can indicate a potential buying opportunity for those aware of historical patterns. For example, previous instances of the index dropping to comparable levels were often followed by notable recoveries in Bitcoin’s price. Investors hoping for a chance to purchase Bitcoin may find these low index readings appealing, knowing that such conditions historically correlate with a reversal in market trends.

Recent Market Trends in Bitcoin

Examining Bitcoin price movements over the last few months reveals significant volatility. Following five consecutive monthly declines, many investors are understandably on edge. However, this volatility can also create opportunities; during previous cycles, price downturns have often led to rebounds. Current analysis suggests that although fear dominates the sentiment, the market may be closer to exhaustion than to a prolonged downturn. Long-standing holders are not just resisting selling; they are accumulating, reminiscent of past cycles when such behavior preempted price increases.

Analyzing Bitcoin Market Dynamics

In terms of market dynamics, several forces shape Bitcoin trading right now. Economic indicators, such as rising interest rates and inflationary pressures, significantly influence trading and investment decisions. Horse traders and analysts alike recognize that Bitcoin’s perceived value is interconnected with macroeconomic conditions. As investors become increasingly aware of these connections, they adjust their strategies accordingly. Long-term holding has surfaced as a popular strategy amid recent fluctuations, highlighting a perception that holding Bitcoin offers protection against ongoing volatility. Awareness of external factors impacting Bitcoin’s market dynamics has never been more critical for effective trading and investing.

Future Outlook on Bitcoin Sentiment

Looking forward, potential signs of recovery are emerging based on the current accumulation patterns observed among long-term holders. Market analysts project long-term positivity, suggesting that despite present fears, the accumulation behavior indicates a growing confidence in Bitcoin’s future. As investors navigate a continuously evolving landscape, staying informed on market dynamics becomes essential for capitalizing on future opportunities. Analysts agree that global economic conditions might continue to compel investors to seek refuge and stability in Bitcoin.

Actions for Navigating Bitcoin’s Market Landscape

Investors looking to navigate Bitcoin’s unpredictable market landscape should consider several strategies. First, assessing personal risk tolerance is crucial; knowing when to enter or exit a position can prevent significant losses. Diversifying investments across various assets, including traditional equities and cryptocurrencies, will create a more balanced portfolio. Prospective investors should also remain vigilant and informed, closely monitoring macroeconomic indicators and sentiment shifts. As the crypto economy in 2026 unfolds, it remains vital to stay ahead of market trends to position themselves for potential gains.

More Stories

How Investors Are Using Economic Indicators to Choose Bitcoin or Gold

Why Bitcoin’s Recent Price Drop Is Impacting the Entire Crypto Market

What No One Tells You About Bitcoin’s Risky Market Position